India’s GST Council has delivered a sweeping overhaul of the Goods and Services Tax (GST), marking its most significant reform in eight years. In a marathon 10.5-hour session, the 56th GST Council meeting, chaired by Union Finance Minister Nirmala Sitharaman, approved the launch of GST 2.0—a streamlined, consumer-friendly tax structure slated to take effect from September 22, 2025, coinciding with the onset of the Navratri festival.

Lok Sabha Passes Gaming Bill: Ban on Cash Play, Green Light for Esports

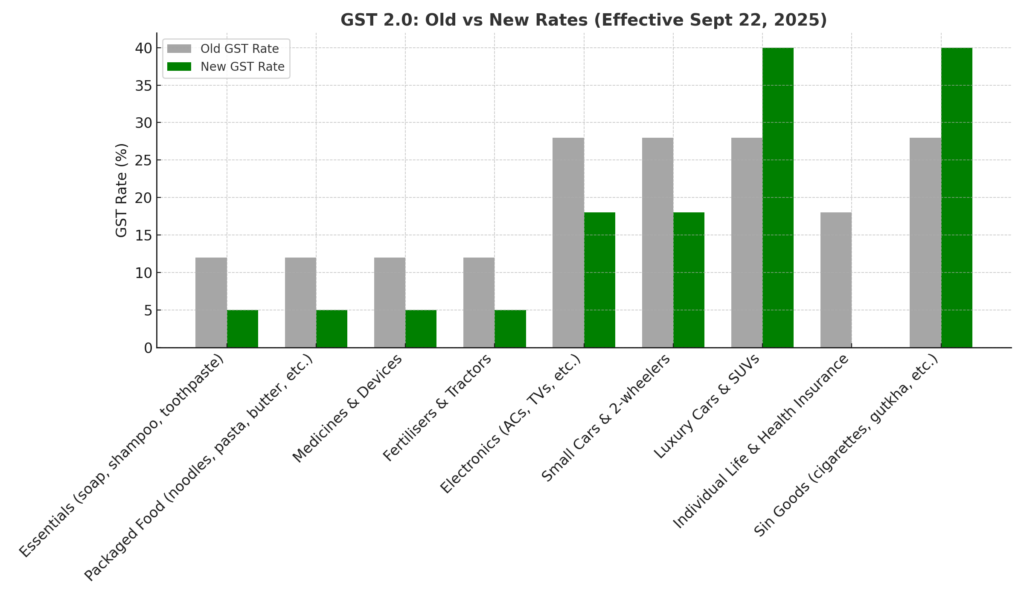

Simplified Rate Structure: 5%, 18% and a Special 40%

Under GST 2.0, the multiple existing tax slabs are replaced by:

- A 5% slab, covering everyday essentials.

- An 18% slab, applying to standard goods and services.

- A 40% “de-merit” rate for luxury, “sin”, and super-luxury items like cigarettes, high-capacity cars, and caramelized beverages.

- This rationalization eliminates the 12% and 28% brackets, significantly simplifying compliance and aiming to reduce revenue and administrative burdens.

What Gets Cheaper (5% or Zero GST)

The GST Council targeted a wide range of essential goods and services for easier access:

- Household and personal care items—hair oil, soap, shampoo, toothbrushes, toothpaste, kitchenware—now taxed at 5% (down from 12% or 18%).

- Packaged foods and beverages—like butter, cheese, coconut water, soya-milk drinks, pasta, noodles, cornflakes, chocolate—shifted to the 5% slab

- Medicines, medical devices, and diagnostics, mostly moved to 5%, with several lifesaving medicines now 0% GST.

- Agricultural and rural economy—fertilisers, tractors, harvesting equipment—slashed to 5%.

- Home appliances and electronics—ACs, TVs, dishwashers—now at 18% (previously up to 28%).

- Automobile segment—small cars (≤1200 cc petrol / 1500 cc diesel), bikes < 350 cc, and automotive parts taxed at 18%; larger and luxury vehicles taxed at 40%.

- Insurance benefit—all individual life and health insurance policies now exempt from GST, offering a major saving for policyholders.

What Becomes Costlier (40% Slab)

The following categories now carry a premium 40% tax:

- Sin goods: Pan masala, gutkha, cigarettes, chewing tobacco, cigars, bidis, and caffeinated or carbonated beverages. GST will now be applied on the Retail Sale Price (RSP) instead of transaction value.

Beyond Bengaluru & Mumbai: How India’s Emerging Cities Are Powering the Startup Boom

Fiscal Impact and Economic Watch

- The reform is expected to result in a revenue loss of ₹48,000 crore (~US$5.5 billion), a more moderate outlook compared to some earlier projections.

- Citi estimates a possible 1.1 percentage point drop in inflation, if full benefits are passed through to consumers.

- Major FMCG firms (like HUL, Nestlé, Godrej), automakers (Maruti, Toyota), electronics manufacturers (LG, Sony), and insurers (LIC, ICICI Prudential) are expected to gain. Insurance stocks already rose as much as 6% on the news.

Process & Structural Reforms Beyond Rates

- Process improvements: Implementation of fully automated refunds and registration, aiming to smoothen compliance.

- GST Appellate Tribunal (GSTAT) set to be operational by end-September 2025, with hearings beginning by December 2025.

Voices from the Council

Despite initial fears of revenue loss, the Council achieved unanimous support for the reforms—citing benefits to farmers, MSMEs, women, youth, and the middle class. Prime Minister Modi confirmed the Council had agreed to the proposals collectively, emphasizing gains for the common man.

GST 2.0 represents a foundational reform—simplifying slabs, reducing costs on everyday essentials, exempting insurance policies, and incentivizing the economy ahead of the festive season. The impact on revenue and inflation will be closely monitored as the new regime kicks in on September 22, 2025.